Articles

- Add a different TD checking account to make around $three hundred far more.

- Scotiabank $300 Greeting Bonus – Greatest Plan Otherwise Popular Package

- TD Beyond Family savings

- Company Paperwork When the Company or Relationship is using their own EIN:

- And this bank card contains the greatest subscribe extra?

- Is sign-up incentives worth every penny?

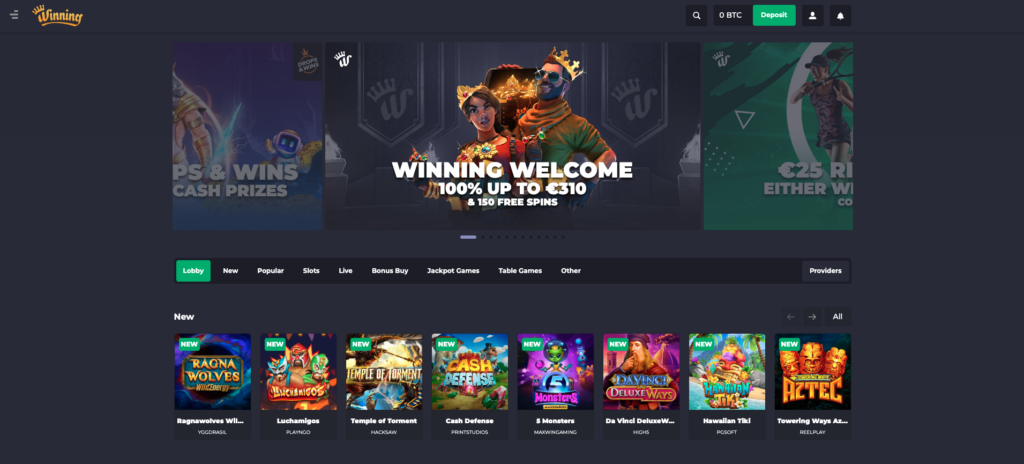

You can also is a almost every other tricks for looking for increased Amex acceptance also provides. I found so it render by going to the new head relationship to the new Amex web site for the Bluish Bucks Well-known cards inside Incognito function within the Chrome. You might constantly proper-click on this link in your browser to start they in the an enthusiastic incognito or personal likely to window. As you like to play and you can gaming to the cardiovascular system’s attention, you’ve got a lot of other bonuses to save you prior to the overall game constantly.

Add a different TD checking account to make around $three hundred far more.

The new also provides stated below have expired and so are not any longer offered. Realize the overview of the capital One Venture X cards to own more details. https://vogueplay.com/in/gold-volcano-play-n-go-string/ Information regarding the new Marriott Bonvoy Boundless Bank card could have been gathered independently from the CNBC Discover possesses maybe not started reviewed or provided by the newest issuer of your cards ahead of book.

Scotiabank $300 Greeting Bonus – Greatest Plan Otherwise Popular Package

Motley Fool Cash is one hundred% had and you will run by the Motley Deceive. But simply so that you know, card issuers either down or lose their top acceptance also offers. After you’ve found a credit and you will a pleasant offer including, it’s a good idea to utilize straight away. If you are looking to have a charge card having a huge greeting provide, we’ve got your shielded.

TD Beyond Family savings

Believe holiday season travel, whenever flights are somewhat expensive. Because of this $three hundred credit, what may have in the first place started unrealistic was really inside budget. One of many cons out of redeeming repeated flyer miles for flights is that — most of the time — you lose out on the capacity to secure elite-qualifying and you may redeemable miles for upcoming explore. Read our very own writeup on the new Sapphire Set aside credit for more information. The brand new Citi / AAdvantage Business world Professional Mastercard have a substantial welcome give value regarding the $step 1,238, according to TPG’s January 2025 valuations.

Company Paperwork When the Company or Relationship is using their own EIN:

The newest Joined Club℠ Infinite Card makes it possible to secure a lot of Joined miles and you may open premium benefits such totally free looked bags and you may entry to United Clubs. Harmony import payment can be applied with this particular offer 5% of each balance import; $5 minimal. The brand new Citi Strata Largest℠ Credit has competitive advantages costs and you can unlocks usage of each one of the brand new Citi ThankYou import partners, and therefore advances the property value your points. The brand new Ink Company Preferred Credit card is ideal for small enterprises who would like to secure plenty of versatile travel rewards. The new Ink Business Popular Bank card is a superb company cards that have helpful professionals, beneficial perks and you may an ample welcome bonus.

And this bank card contains the greatest subscribe extra?

Look at the World of Hyatt Organization Bank card when you’re a small business operator which regularly stays from the lodging regarding the Hyatt collection. The new IHG One Rewards Prominent Borrowing Card’s benefits are really easy to optimize, which makes so it card a solid option for many who remain at IHG functions semi-frequently. Items can be worth fifty% a lot more when you get them to have travel set aside as a result of Chase Take a trip℠. Discover often suits the cash return you’ve earned at the prevent of your first year. Items are worth 25% more once you receive them for take a trip set aside as a result of Pursue TravelSM.

Is sign-up incentives worth every penny?

Payouts to the incentives away from lender also provides and you can bank card offers are different. Per provide can get detail if bonus would be gotten, thus realize everyone provide cautiously. Completing the fresh ten being qualified transactions is easy since the all pursuits like debit card purchases, view places, and you may Automatic teller machine transactions count.