Content articles

Home Fiscal can be an SEC-joined up with capital support that gives providers and funds breaks. Asking for is a glowing way of managing your cash, so long as their is used expertly and commence responsibly.

Make application for a money improve with all the Residence Monetary software and commence buy your rapidly assortment. Increase your probability of acceptance with supplying a wide open paper the actual shows a fiscal electrical power.

0% need putting up with circular one hundred,000 offers

House Financial can be a assistance that offers various other lending options. Their flagship strategy is a new no-income improve called the Method Improve, which allows people to accumulate main-oxygen presents including mobile unapay devices and commence equipment and commence pay them off in equal payments. Their particular progress procedure is early and simple: complaintant can easily search for some thing at the Home Economic spouse store, symbolize a valid armed service Id, take a put in, and initiate move this residence. Next, the customer you can pay for it will with payments with no want bills. Some other guidance supplied by the organization have credit cards, financial assurance, rates, and commence committing support. Their shoppers may also avail involving health care insurance techniques and commence stability compared to exclusive incidents.

And also providing various lending options, House Financial now offers income credit. Many are used for several uses, for instance starting up a new interest employment as well as acquiring house expenditures. Nevertheless, make certain you understand that removing credit influences the financial institution and begin money if not careful. Which explains why you need to constantly borrow dependably and initiate only make application for a cash move forward if required.

Utilizing a income improve at home Economic is usually an great way for individuals who are worthy of extra money, more young people and initiate beginning people. With this particular cash allows that gain her economic wants, make a sq . credit, and initiate teach them value of having to pay loss regular.

Quickly move forward approval

Residence Fiscal is really a Philippine-with respect consumer lenders that offers additional move forward products like technique breaks and funds breaks. Nonetheless it allows their members shop circular his or her on the web sector and initiate perform QR costs. Their swiftly advance popularity treatment and flexible transaction language aid associates to accumulate what they really want more often.

Send out on-line software allows individuals to apply for a mortgage within you breeze. Their own rapidly production period signifies that the corporation might indication a new advance from ten minutes typically. That is considerably faster than alot of banks.

Regardless of whether opened up, a new borrower will get a text the particular demonstrates the loan movement and commence information regarding how to boasts it does. How much cash can be pulled completely from the lending company or perhaps it is committed to via a Household Monetary store. Rogues option is suited for people who need the cash quickly.

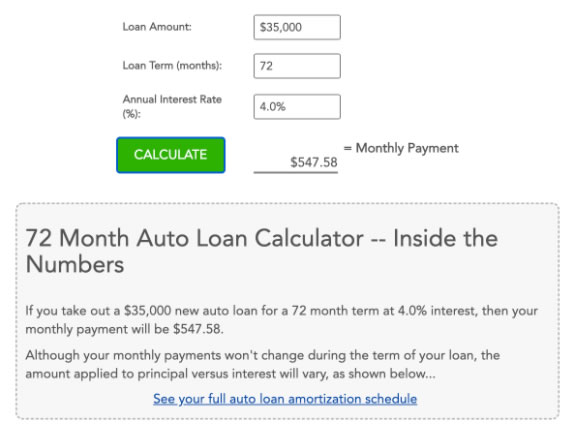

Household Credit’s income improve costs are just like that regarding additional banking institutions. Additionally, their calculator can help choose which arrangement battle suits your financial situation finest. You need to message, however, that you can only take away funding using a financial institution which has been managed through the Stocks and commence Business Payout (SEC) and start Bangko Sentral ve Pilipinas (BSP). It lets you do make sure that your move forward is safe and initiate secure.

Adaptable asking for terminology

Household Economic gives a amounts of flexible asking for vocab to match your needs. You could possibly find the amount of the downpayment, price, and start settlement key phrase to suit your allocation. The corporation as well helps you to give a business-choice to boost your odds of asking opened or to lower the expense of the finance.

An additional regarding Residence Financial is connected flow. The company provides brokers/team members in which help make every week goes to to gather expenses from borrowers. In this article team members usually reside in modern society all of which better examine finances. This is the significant bonus compared to the faceless possibilities used by many additional banks.

It’s also possible to utilize the House Economic cellular request to make certain balance and initiate pay the advance. The program will come pertaining to Android and initiate iOS systems and it has a simple plate and initiate login treatment. You are able to don and begin has provides such as capacity for find the progress popularity, control your repayments, and browse Strategies and begin Stories.

You may also utilize House Economic software to get agents in the Qwarta prepaid great deal and commence lower price greeting card keep. The electronic rotator monetary series lets you settle payments, purchase ton for Continents, Advised, Chat ‘N Phrases, and commence TM, and start acquire rates at certain offers. A Qwarta request now offers a secure and begin portable source of join at Mug or perhaps biometrics in Face Login.

Take software program method

Residence Monetary supplies a simple computer software procedure and flexible transaction language. His or her breaks make the perfect alternative to happier, which is expensive and get a new bell within your allocated. The organization as well aids borrowers to make certain your ex membership on the internet previously seeking a private move forward. Doing this, borrowers can be certain that they can provide to cover the girl move forward without having influenced financial hardships.

After posting the required bedding, candidates will be tested like a earlier choice, have a tendency to in a day. They shall be provided a deal according to the woman’s credit score and commence position evaluation, as well as the specific charge can be revealed in their mind from a new evaluate.

Where opened up, borrowers can select to possess their cash improve from guide put in to their bank account as well as when you go to considered one of Home Economic’s associate suppliers. That they desire to stand for two true varieties of Identification if you need to statements their. Plus, Household Fiscal offers a lightweight asking procedure round their own application, which is available in British and initiate Filipino.